Contact Us Now for Trusted Debt Consultancy Services in Singapore

Contact Us Now for Trusted Debt Consultancy Services in Singapore

Blog Article

Discover Exactly How Expert Financial Debt Specialist Providers Can Aid You Gain Back Financial Stability and Handle Your Debt Effectively

In today's complex financial landscape, many people discover themselves facing frustrating financial debt and uncertainty about their financial future. debt consultant singapore. Expert financial obligation consultant services supply a structured method to restoring stability, providing customized methods and professional insights created to resolve distinct economic obstacles. By leveraging their expertise in settlement and financial debt administration, these consultants can produce efficient settlement plans that relieve anxiety. Nevertheless, recognizing the full extent of their advantages and how to pick the ideal professional is critical to achieving lasting economic health and wellness. This exploration exposes crucial considerations that can significantly affect your journey toward economic recovery.

Recognizing Financial Obligation Specialist Provider

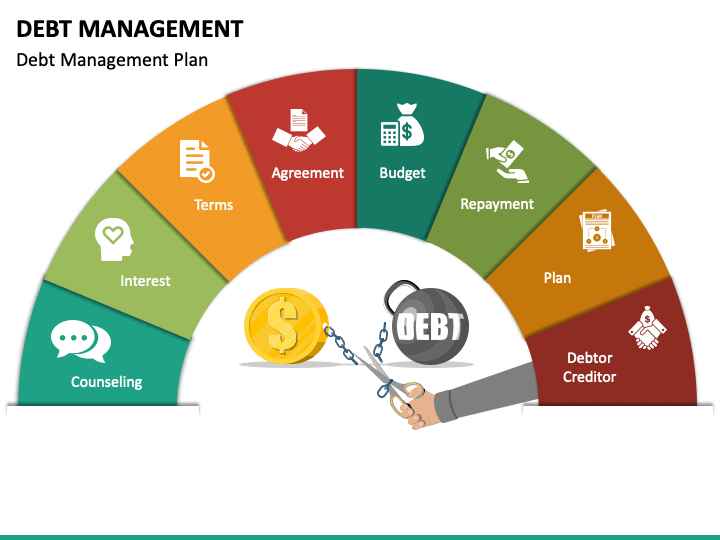

Debt specialist services provide people and organizations with expert assistance in managing and fixing monetary commitments. These solutions objective to assist clients in navigating intricate monetary landscapes, providing tailored approaches to resolve varying levels of financial debt. A debt expert typically examines a client's financial situation, including revenue, expenditures, and existing financial obligations, to formulate a comprehensive strategy that straightens with their one-of-a-kind needs.

Consultants utilize a variety of methodologies, such as budgeting help, financial debt loan consolidation choices, and arrangement with lenders - debt consultant singapore. By leveraging their know-how, they can help clients recognize the effects of their financial obligation, including rate of interest rates, settlement terms, and prospective lawful repercussions. Additionally, professionals commonly enlighten customers concerning economic literacy, encouraging them to make enlightened choices that can result in long-term monetary health

Additionally, these solutions may include creating structured repayment strategies that are sustainable and manageable. By collaborating carefully with clients, financial debt experts cultivate a supportive atmosphere that encourages commitment to financial discipline. In general, recognizing the scope and features of financial obligation expert solutions is crucial for individuals and services looking for reliable options to their economic challenges, inevitably paving the way to greater monetary stability.

Benefits of Expert Support

Specialist support in financial debt administration uses numerous advantages that can considerably improve a person's or organization's monetary scenario. Among the key advantages is accessibility to expert expertise and experience. Financial debt experts possess a deep understanding of different financial products, legal policies, and market conditions, enabling them to give informed suggestions tailored to details situations.

Moreover, financial debt specialists can use negotiation skills that individuals might lack. They can connect effectively with financial institutions, potentially protecting much better settlement terms or lowered rate of interest. This advocacy can cause a lot more desirable outcomes than people might attain by themselves.

Tailored Strategies for Debt Administration

Reliable financial debt administration requires greater than simply a basic understanding of monetary commitments; it demands approaches customized to an individual's unique circumstances. Each individual's monetary situation is distinct, affected by different elements such as earnings, expenditures, credit scores history, and personal goals. Specialist financial debt experts excel in creating personalized plans that resolve these particular aspects.

Via a comprehensive analysis, specialists determine one of the most pressing financial debts and evaluate spending habits. They can after that propose effective budgeting techniques that align with one's way of life while focusing on financial obligation settlement (debt consultant singapore). Additionally, experts may suggest consolidation strategies or arrangement techniques with financial institutions to lower rates of interest or develop workable layaway plan

A substantial advantage of customized strategies is the adaptability they use. As circumstances change-- such as task loss or enhanced expenses-- these methods can be changed accordingly, making sure continuous relevance and efficiency. Additionally, professionals give continuous support and education and learning, empowering people to make enlightened choices in the future.

Ultimately, customized debt monitoring methods not only promote immediate relief from financial problems however additionally foster long-term monetary security, allowing individuals to reclaim control over their finances and accomplish their economic objectives.

Just How to Pick a Specialist

Exactly how can one make sure that they select the appropriate financial obligation expert for their demands? Choosing a financial debt expert needs careful consideration of numerous essential factors. Initially, evaluate their qualifications and experience. Seek consultants with appropriate qualifications, such as those from the National Structure for Credit Rating Therapy (NFCC) or the Organization of Credit Score Therapy Professionals (ACCP) Their expertise in taking care of financial debt services is essential.

Following, assess their credibility. Study online reviews and endorsements to assess the experiences of previous customers. A trusted consultant will certainly commonly have favorable comments and a performance history of effective financial obligation management outcomes.

It is additionally necessary to understand their technique to financial debt management. Set up an appointment to review their techniques and guarantee they straighten with your financial goals. Openness relating to services and fees is important; a trustworthy consultant must give a clear rundown of prices included.

Finally, think about the consultant's communication style. Choose somebody who listens to your issues and solutions your inquiries plainly. A solid connection can promote a joint partnership, vital for properly managing your financial debt and achieving economic security.

Actions to Achieve Financial Security

Achieving monetary security is a systematic process that entails a series of intentional actions tailored to private scenarios. The very first step is to evaluate your present financial circumstance, including income, expenses, financial obligations, and properties. This detailed assessment provides a clear image our website of where you stand and assists identify locations for renovation.

Following, develop a practical budget that prioritizes necessary expenses while assigning funds for debt repayment and savings. Staying with this budget plan is vital for preserving economic technique. Following this, check out debt management choices, such as combination or arrangement, to decrease rate of interest and month-to-month settlements.

Establish a reserve to cover unanticipated expenditures, which can protect against reliance on credit and further financial obligation accumulation. As soon as immediate financial stress are dealt with, concentrate on long-term monetary objectives, such as retirement savings or financial investment methods.

Conclusion

To conclude, professional financial debt consultant services supply valuable resources for people looking for monetary stability. By giving expert support, customized strategies, and ongoing support, these consultants help with reliable best debt consultant in singapore debt administration. Their capability to work out with financial institutions and create tailored repayment plans considerably improves the probability of achieving economic healing. Inevitably, involving with a financial debt professional can result in a much more informed method to personal money, cultivating lasting stability and satisfaction.

In today's intricate monetary landscape, many individuals locate themselves grappling with overwhelming financial obligation and uncertainty regarding their monetary future. Specialist debt professional solutions offer a structured strategy to regaining stability, supplying customized approaches and professional understandings designed to attend to special financial challenges. A debt specialist normally assesses this a client's economic circumstance, consisting of income, expenses, and existing financial obligations, to formulate a comprehensive strategy that lines up with their distinct needs.

In general, recognizing the range and features of financial debt expert solutions is crucial for services and people looking for efficient solutions to their financial challenges, eventually leading the means to higher economic security.

In final thought, expert debt consultant services supply beneficial sources for people looking for monetary stability.

Report this page